Owning an RV is more than just a ticket to adventure—it’s an investment in a lifestyle of freedom, exploration, and even financial savings. If you’re an RV owner in Huntsville, AL, or the surrounding areas, you’ll be thrilled to know that your RV can offer more than just scenic road trips and cozy campfires. It can also provide some significant tax benefits! At Fireside RV in Huntsville, AL, we’re here to help you make the most of your RV ownership, from finding the perfect rig to understanding how it can save you money come tax season.

In this blog post, we’ll explore the tax benefits available to RV owners, how to qualify for them, and why Huntsville, AL, and its surrounding areas are the perfect backdrop for your RV adventures.

1. Claim Your RV as a Second Home: The Mortgage Interest Deduction

One of the most valuable tax benefits for RV owners is the ability to deduct the interest paid on your RV loan, similar to how you would with a traditional home mortgage. To qualify, your RV must meet the IRS definition of a “second home,” which includes having sleeping, cooking, and bathroom facilities. Luckily, most RVs easily meet these requirements.

How It Works:

- If you finance your RV, the interest you pay on the loan may be tax-deductible.

- This deduction applies whether you use your RV for personal trips or rent it out (more on that below).

- There are limits to how much you can deduct, so consult with a tax professional to ensure you’re maximizing this benefit.

Why It Matters:

For many RV owners, this deduction can significantly reduce taxable income, making RV ownership more affordable over time.

2. Renting Out Your RV: Unlock Business Deductions

If you’re not using your RV full-time, renting out your RV can be a fantastic way to offset ownership costs. At Fireside RV in Huntsville, AL, we help local RV owners connect with travelers looking to explore the Rocket City and its surrounding areas. But did you know that renting your RV can also open the door to additional tax benefits?

How It Works:

- When you rent out your RV, you can deduct expenses related to the rental activity, such as maintenance, repairs, insurance, and even depreciation.

- If you rent your RV for fewer than 15 days per year, the income is typically tax-free.

- For longer rental periods, you’ll need to report the income, but you can also deduct a proportionate share of your RV expenses.

Why It Matters:

Renting your RV not only generates extra income but also allows you to write off many of the costs associated with ownership. It’s a win-win for your wallet!

3. Full-Time RV Living: Deduct Travel Expenses

For those who embrace the full-time RV lifestyle, your RV may qualify as your primary residence. This opens up additional tax benefits, especially if you travel for work or run a business from the road.

How It Works:

- If you use your RV as your primary home and travel for business purposes, you may be able to deduct travel expenses, including fuel, campground fees, and maintenance.

- Keep detailed records of your business-related travel to substantiate your deductions.

- Full-time RVers can also deduct a portion of their RV’s depreciation, insurance, and other expenses.

Why It Matters:

Full-time RV living offers unparalleled freedom, and the tax benefits make it even more appealing. Whether you’re a digital nomad or a seasonal worker, these deductions can help you save big.

4. Sales Tax Deductions

When you purchase an RV, you’ll typically pay sales tax. However, in some cases, you may be able to deduct this sales tax on your federal income tax return.

How It Works:

- If you itemize your deductions, you can choose to deduct state and local sales taxes instead of state income taxes.

- This can be particularly beneficial in states like Alabama, where sales tax rates vary by location.

Why It Matters:

This deduction can help offset the upfront cost of buying an RV, making it easier to get started on your RV adventures.

5. Explore Huntsville, AL, and Beyond: A Perfect RV Destination

Huntsville, AL, is not only a fantastic place to start your RV journey—it’s also a gateway to some of the most beautiful and exciting destinations in the Southeast. From the rolling hills of North Alabama to the stunning landscapes of nearby Tennessee, your RV opens the door to endless adventures.

Why Huntsville?

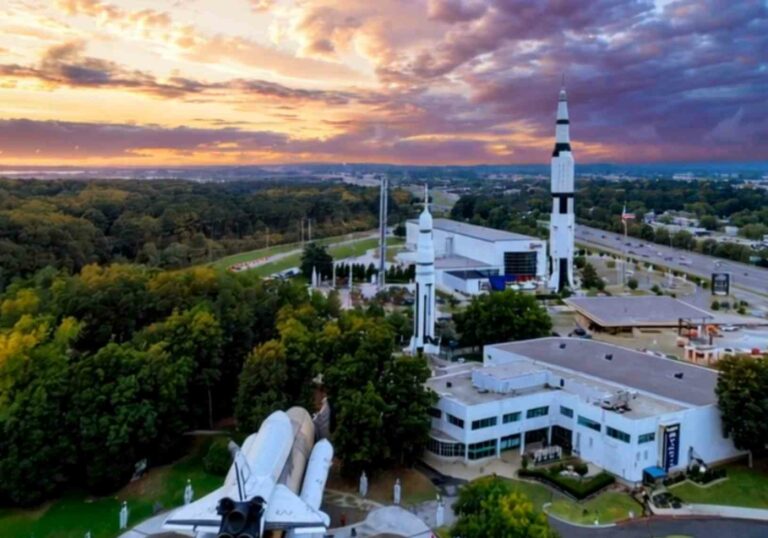

- Local Attractions: Explore the U.S. Space & Rocket Center, Monte Sano State Park, or the vibrant downtown Huntsville scene.

- Nearby Destinations: Take your RV to nearby gems like Guntersville Lake, Decatur, or Lynchburg, TN (home of the Jack Daniel’s Distillery).

- Campgrounds: Enjoy top-rated campgrounds in the area, such as Monte Sano State Park Campground or Huntsville KOA.

At Fireside RV in Huntsville, AL, we’re proud to serve the local community and help RV enthusiasts make the most of their adventures. Whether you’re looking to buy, rent an RV in Huntsville, or simply learn more about the RV lifestyle, our team is here to help.

Final Thoughts: Make the Most of Your RV Investment

Owning an RV is about more than just hitting the road—it’s about embracing a lifestyle of freedom, adventure, and financial savvy. By taking advantage of the tax benefits available to RV owners, you can make your investment go even further.

At Fireside RV in Huntsville, AL, we’re here to help you every step of the way. Whether you’re looking to explore the Rocket City or venture out to nearby destinations, our team is ready to assist. Stop by our location or give us a call to discover how we can help you unlock the full potential of RV ownership.

Ready to hit the road? Let Fireside RV be your guide to adventure and savings!

Disclaimer: This blog post is for informational purposes only and should not be considered tax advice. Please consult with a qualified tax professional to understand how these benefits apply to your specific situation.